Despite weak freight rates so far this year, Dry Bulk shipping earnings are forecast to recover as demand for both major and minor bulk commodities rises, according to the Dry Bulk Forecaster report published by shipping consultancy Drewry.

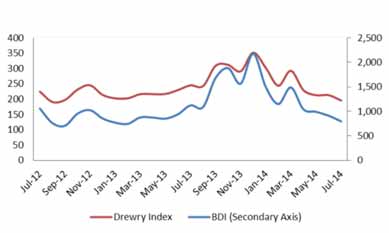

Freight rates have been depressed due to a continuing oversupply of vessel capacity, despite recent moderation in the growth of the fleet. Drewry’s Dry Bulk Freight Rate Index, a weighted average of earnings across multiple trades, declined 39% in the six months to June.

Drewry estimates that the dry bulk global fleet grew at an annual rate of 1.3% in the second quarter of 2014, down 0.4% on the first quarter. Some of this growth was the result of declining inactivity as vessels previously laid up due to bankruptcy proceedings came back onto the market. But much of the damage relates to over ordering of previous years, which has left the industry with an operating surplus of over 240 million dwt.

Despite this, activity in the newbuilding market has increased, due largely to demand for eco-vessels. Ordering for Capesize and VLOC (very large ore carrier) vessels has increased on a positive outlook for coal and iron ore trades. The current overall orderbook represents around 23% of the

global fleet. On the demand side, strong growth in Chinese iron ore imports were partly offset by a contraction in coal and grain shipments. Chinese imports of iron ore grew 12% quarter- on-quarter, driven by domestic smelters’ preference for high quality and low cost imports. Grain shipments were impacted by adverse weather conditions and geopolitical issues in Eastern Europe. Chinese steam coal imports declined around 4% in the year to June, reducing earnings of Capesize and Panamax vessels. Chinese imports of iron ore are expected to slacken off through the remainder of the year due to large stockpiles, but demand is forecast to grow at an annual rate of 6% in the period to 2019.

“The immediate outlook for bulk shipping is positive,” said Rahul Sharan, Drewry’s lead dry bulk shipping analyst. “Despite weak market conditions through the first half, average time charter rates for 2014 are expected to be higher than 2013 as Drewry expects rates to increase in the second half.”

Driving much of this recovery will be increased demand for both major and minor bulk commodities.

“Looking further ahead, we expect earnings to recover gradually across all vessel segments over the next few years,” added Sharan.

Dry Bulk Forecaster is published quarterly by Drewry Maritime Research.

Drewry is an international firm of shipping consultants that provides advice and research to maritime industry stakeholders. It provides these services via four established business units: Drewry Maritime Advisors provides advice to shipping and financial institutions; Drewry Supply Chain Advisors provides advice to retailers and manufacturers; Drewry Maritime Research publishes research on shipping markets; and Drewry Maritime Equity Research provides equity research on selected shipping companies.

Drewry has over 40 years’ experience in the maritime sector, employing over 100 specialists across an international network of offices in London, Delhi, Singapore and Shanghai.

Drewry empowers its clients with the necessary information and knowledge to make informed business decisions. The company is renowned for the quality of its work, with analysis that brings clarity to complex markets and enables clients to get ahead of the competition.