by Richard Scott, Bulk Shipping Analysis

Signs of extra support for commodity imports into

countries around the world have become more

prominent during the past few months. Growth in

global seaborne dry bulk trade has benefited. But there are

still doubts about whether this improved pace can be

sustained during the remainder of 2017.

A moderately encouraging background is provided by

recent economic indicators. In the USA, European Union and

Japan statistics point to more positive trends, implying

stronger manufacturing and construction activity. In China,

although the economy still appears to be well supported,

rapidly growing debts reflected in policies designed to curb

lending may adversely affect economic growth over the

period ahead.

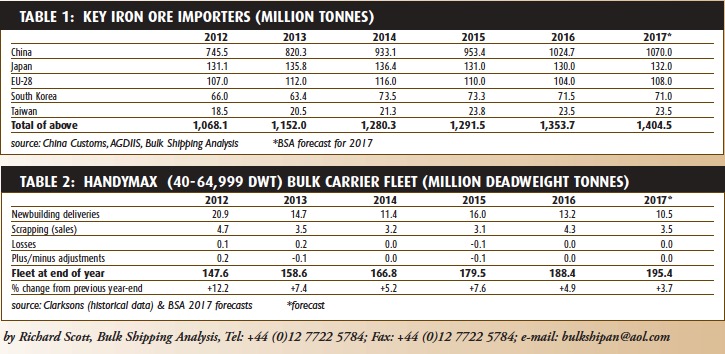

IRON ORE

Steel production started this year briskly in the main raw

materials importing countries. World Steel Association

figures show that China’s crude steel production in the first

four months of 2017 was 4.6% above the volume seen in

last year’s same period, at 274mt (million tonnes). EU

output was 4.5% higher at 57mt, while South Korea’s total

was up by 2.8% at 23mt. Japan achieved a 1.9% increase to

35mt.

While these rises imply additional imports of iron ore

(shown in table 1) and coking coal, other factors can alter

the relationship. Attention immediately focuses on China,

the dominant ore importer. Further substitution of domestic

iron ore supplies from Chinese mines with imports continues,

but some of the large expansion of imports in recent months

has been stored at ports. If these greatly expanded stockpiles

are drawn down, import demand could be weakened.

COAL

Some forecasters are more confident about an increase in

global seaborne coal trade in 2017 after decreases in the

past two years. However, negative influences affecting

import demand in many countries remain clearly visible.

These are likely to persist in the longer term, given the

worldwide strategy of switching towards cleaner fuels and

renewable energy.

A large part of this year’s expected growth in the global

trade total is likely to reflect higher volumes into China.

Already there has been a big rise. China’s coal imports during

the first four months of 2017 were 22mt or one-third above

the same period of last year, reaching over 89mt. Both steel

production and thermal power generation expanded, and

additional domestic coal output only slightly restrained imports.

GRAIN

Global trade in wheat and coarse grains in the 2016/17 crop

year ending this month looks set to edge upwards by 1%,

reaching 349mt, according to the International Grains

Council’s latest estimates. Tentative calculations for the new

2017/18 year starting July suggest little change, just a small

decrease to 347mt.

What clues about trade over the next twelve months have

emerged? One indication is summer domestic grain harvests

in northern hemisphere importing countries. Changes in

these often affect foreign purchases. Currently there are

more signs of higher production than lower output, but

weather conditions over the weeks ahead will determine the

results. Importers expected to achieve greatly improved

harvests include France, India and Morocco.

MINOR BULKS

Forest products trade provides many bulk as well as non-bulk

cargoes, including logs, sawnwoods, woodchips and pulp and

other items. It is one of the largest ‘minor’ bulk categories,

with global seaborne movements probably exceeding 350mt

last year. Further growth could be aided by reviving

construction and manufacturing activity in some importing

countries.

BULK CARRIER FLEET

Among bulk carrier size groups, the Handymax 40–64,999dwt

group is still growing briskly (see table 2), possibly

increasing by 4% in 2017. Newbuilding deliveries are likely

to decline this year, but scrapping of older vessels probably

will be reduced also. Most of the new ships being delivered

are in the ‘Ultramax’ sub-group (capacity exceeding 60,000

deadweight), a popular choice when ordered a few years ago.