Recent months have seen global steel demand accelerate to record highs, as parts of the world emerge from COVID restrictions and lockdowns. In China, steel consumption has been driven by the 3.6 trillion (US$550 billion) yuan steel-intensive stimulus package initiated by the government early last year.

Robust steel demand from China’s construction sector has continued at a rate of knots in 2021, aided by an increase in fixed asset investment of 19.9% yoy in the first four months. Steel production reached a new first quarter record of 269 MnT (up 15% yoy) and surged to a record 97.9 MnT in April. This is approaching a maximum; utilisation levels have been very high with Basic Oxygen Furnace capacity currently running at over 90% in mid-May.

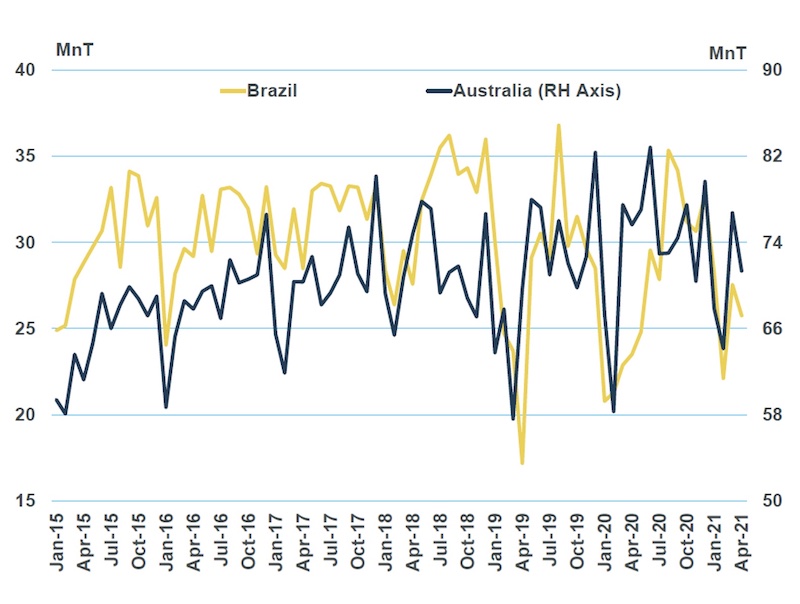

As steel demand strengthens across the world, iron ore supply has struggled to keep up. Weather-related disruptions have affected producers in both Australia and Brazil, whilst maintenance issues at a large mine owned by Vale further restricted output in the latter. The chart plots Brazilian and Australian iron ore exports this year derived from vessel movements data – for the third year in a row, Q1 shipments have been hugely disrupted and lower than capacity. In total, Brazilian and Australian shipments were down 11% quarter on quarter and still below the Q1 levels in 2017 and 2018.

Weaker output in these core iron ore supply countries has been partly offset by stronger exports from India and Malaysia (both over 5 MnT higher yoy in Q1), noting that stronger trade on these routes employs a larger share of ships smaller than Capesize.

Key to the outlook for trade in the rest of this year, though, will be the pace of recovery for exports from Australia and Brazil. Production guidance from the key miners provides a good indication.

For Brazil, Vale expects production expected to increase significantly in coming quarters to meet production guidance of 315-335 MnT, from 300 MnT in 2020. This will be supplemented by increasing exports from Vale/BHP’s JV Samarco project. Including other capacity (such as Minas Rio) MSI forecasts Brazilian exports this year of 385 Mn Dwt, up 13% yoy.

While Brazilian exports are expected to increase significantly in the coming months, the outlook for Australian capacity is less positive. Rio Tinto has maintained its yearly production guidance of 325 MnT to 340 MnT. BHP still expects annual production to be closer to its upper band of production guidance of 245 MnT-255 MnT. As a result of poor Q1 figures we have reduced expectations for Australian ore exports by 4.1 MnT for this year, with exports now growing by less than one percent from last year.

Aside from the two major exporters, India has also been a source of growth so far this year. According to movements data, 10.1 MnT of iron ore was exported from India in March and April compared to 4.8 MnT in the same two months of 2020. Indian exports are expected to continue to be firm in the coming months as domestic requirements are limited by a second wave of COVID infections.

The country’s steel output is expected to drop by around 20% in Q2 compared to Q1, partly due to COVID- related labour issues and also shortages of oxygen on the back high demand for hospitals; this will free up iron ore for export.

Of the remaining exporters, shipments from Canada and Malaysia will also increase, supported by high demand and prices. Overall, MSI has slightly increased our forecast for iron ore trade growth this year to just under 7% yoy.

Beyond the balance of 2021, Brazil is expected to be the main source of incremental export growth. Vale’s production capacity is now anticipated to reach 350 MnT by the end of this year and MSI is more positive on medium-term Brazilian production. As a result, we have increased our forecasts for 18.8 MnT. This dynamic should be key for supporting tonne-mile growth for the Capesize segment over the next few years.

Meanwhile, MSI anticipates an average of 11.6 MnT of incremental growth in Australian exports from 2022 to 2025 as miners expand by a small amount of additional capacity. This assumes that iron ore trade on this route continues to be ringfenced from the political tensions between the countries that have otherwise had a dramatic impact on the coal market.