by Richard Scott, Bulk Shipping Analysis.

Recent news and statistics confirm that, in a range of

dry bulk trades, activity is still buoyant and

prospects through 2011 seem positive. Signs of

additional import demand for commodities are clearly

visible. But evidence pointing to a temporary slowing of

economic growth in major dry bulk importing areas has

become more prominent, implying some negative effects on

trade volumes.

Amid huge problems faced by many countries in the

aftermath of the ‘Great Recession’, current difficulties are

hardly surprising. The Asian Development Bank recently

highlighted “the continued fragility and uncertainty of

recovery in the industrialized countries”, commenting that

the global recovery “remains shaky”. However, further

useful support from emerging markets’ dynamic progress is

expected.

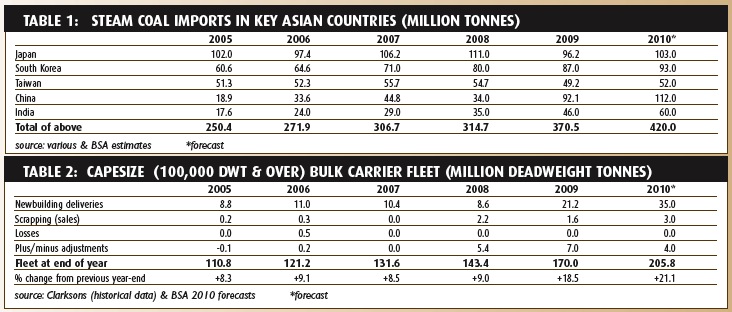

COALStrong import demand for steam coal is one promising

aspect. As shown by table 1, countries in the Asian region

are buying more foreign supplies. Extra purchases by China

and India are especially notable. World seaborne steam coal

trade could rise by 7–8% in 2010, followed by further growth

next year.

India’s coal imports expansion is attracting much

attention. After growing strongly to reach about 85mt

(million tonnes) in 2009, another large increase, possibly

about 20%, could push overall steam and coking coal imports

up to around 100mt this year. Indian steam coal purchases,

now comprising over two-thirds of the total, are advancing

rapidly as coastal power stations increasingly use foreign

material to augment domestic supplies.

IRON ORERestraining influences affecting global iron ore trade have

become prominent. In the third quarter of this year, China’s

imports totalled 148mt, continuing a steady decline in

quarterly volumes since the peak 172mt was reached in last

year’s third quarter. An upturn during the 2010 final three

months is widely predicted, but the annual volume is likely

to be below last year’s total.

Blast furnace pig iron production figures for the

July–September 2010 quarter provide more evidence of

flattening iron ore consumption trends. In Japan, pig iron

output recovered strongly to 20.1mt in last year’s final

quarter, since when it has advanced only modestly to 20.8mt

in the latest period. European Union production averaged

24.4mt during the past three quarters, and South Korea has

averaged 7.7mt in the past four quarters.

GRAINGlobal import demand for grain remains subdued.

International Grains Council estimates suggest that world

trade in wheat, corn and other coarse grains will be almost

unchanged in crop year 2010/11 ending June, at 239.6mt.

Asian and Middle East imports are likely to decline, but in

North Africa, Europe and Russia, offsetting increases are

expected.

Imports of grain into Russia were almost nil in the

previous two crop years, but could rise to about 4mt in the

current twelve months. This summer’s harvest shortfall,

when production fell by one-third to 63mt, has resulted in

Russia’s role as a key exporter temporarily ceasing, and a

potential import demand for a substantial quantity to

augment tight domestic supplies.

MINOR BULKSAluminium production among key areas importing raw

materials — bauxite and alumina — is showing limited signs

of growth. In North America, output has been flat in the

past twelve months. West Europe’s quarterly output

increased steadily during that period and in third quarter

2010 was 6% higher than a year earlier. China’s quarterly

output over the same period rose by 4%.

The world fleet of Capesize ships is growing faster than other

bulk carrier size groups and probably will continue expanding

very rapidly next year as well. As shown in table 2, a

massive volume of newbuilding deliveries, accompanied by

more tanker conversions and low scrapping, is likely to result

in Capesize fleet deadweight capacity exceeding 20% growth

in 2010. The end-December total could reach about 206m

dwt.